India's interests and capabilities extend well beyond the sub-continent. This essay is part of a series that explores the geopolitical dimensions, economic ties, transnational networks, and other aspects of India's links with the Middle East (West Asia) -- a region that plays a vital role in India's economy and its future. More ..

For the past four decades, Energy and Manpower have been the two principal drivers of India’s economic relations with the Gulf Cooperation Council (G.C.C.). India has been heavily dependent on energy supplies from the region, while Indian expatriates have constituted a substantial, if not a dominant, share of the regional labor market. To be sure, this relationship has been mutually advantageous. Nevertheless, the relationship remains far less diversified and productive than it could be.

Against the backdrop of the global geo-economic shift from West to East, India and its G.C.C. counterparts can, and should, seize the opportunity to recalibrate and reshape their economic relations. This essay discusses how the adoption of a value chain approach and its application to the healthcare high-tech digital service sectors.

Repositioning India-G.C.C. Relations in the Economic Reform Matrix

To move beyond its traditional transactional mode, the India-G.C.C. economic relations have to be positioned bilaterally and regionally into a production and service network in the form of a value chain. The advantage of a value chain approach lies with the fact that it promotes linkages down the line of value creation. Thus it promotes interdependencies because every stage of value creation is mutually linked. Further, it encompasses a wide range of engagement — from R&D to design and manufacture, distribution etc. Thus, value chain dynamics create mutual stakes in the project, thereby bolstering the relationships between and among the participants.

Globalizing India is transforming its overseas trade profile by engaging in global and regional value chains. In order to enhance its share in global value creation, India needs to form its global and regional supply chains.”At present, India has a limited number of products where it leads in GVCs [global value chains]; as a result, its share in total value added created by trade is not more than 1 per cent, as compared to 9 per cent in China.”[1] The Indian government is encouraging private players to take lead in this direction. The Gulf region provides the opportunity, as it has embarked upon a comprehensive plan of diversification and is expanding its economy on the strength of high-tech, digital service sector.[2] To illustrate a case for transforming the matrix of the relationship, the paper confines its analyses to two sectors prioritized by the Gulf region and where India has a competitive advantage, namely healthcare and digitalization with start-ups as agent of entrepreneurship creation.

Forging a Regional Value Chain for an Inclusive Healthcare Regime

The Gulf states are in the process of revising the terms of the social contract by relocating the social sector in market domain. In doing so, they are pushing for competitive cost for social services like healthcare by benchmarking on efficiency. Estimates suggest that the healthcare market in the Gulf countries is likely to grow by 12.1 percent CAGR in the next five years. In value terms, it is expected to grow from $40.3 billion in 2015 to $71.3 billion in 2020.[3]

The healthcare industry consists of a long value chain, from hospitals to medical professionals, management personnel, medical equipment, clinical trials, telemedicine, health insurance etc.

Health reform proposals in the Gulf region are also opening opportunities for creating a value chain. G.C.C. governments are seeking to ‘indigenize’ the healthcare sector. However, efforts to achieve this aim have been stymied by a paucity of professionals and the high cost of treatment.[4] The rising cost of healthcare could pose the issue of accessibility, hence a political question. This calls for crafting healthcare regime, economic, affordable by a new business model. The new model, though driven by the private sector on the strength of local capacities, has to be linked with an overseas value chain so that a competitive healthcare regime with global standards could be created.

Driven primarily by the private sector, healthcare has emerged as a vibrant sector of India’s growth story. Having reached $100 billion in 2015, this sector is expected to be growing by an annual growth (CAGR) of 22.9 percent during 2015-2020 to $280 billion.[5] With the application of information technology (IT) in healthcare services, a totally new segment has opened where India enjoys comparative advantage. Consequently, India has emerged as a leading service provider in fields such as diagnostic services (teleradiology); medical opinion and consultations (telemedicine); laboratory testing; transmission and processing of specialized data and records (medical transcription); and medical coding and medical billing. India is a leader in exporting medical transcription, telepathology, and telediagnostic services.

The Indian healthcare sector is attracting clienteles from abroad, including the Gulf countries, on the strength of its competitive cost and competence.[6] The Gulf companies are looking to invest in the Indian healthcare sector too. “ Dubai-based buyout fund Abraaj Group is in advanced discussions to acquire a controlling stake in south India’s leading diagnostics services provider Medall Healthcare Pvt. Ltd.”[7] The emerging volume of medical traffic certainly leads to trade creation but does not contribute in transforming the transactional nature of the relationship. The case made in this paper is to integrate the Gulf healthcare sector by co-creating a value chain. Further, the high degree of dependence of the Gulf healthcare sector on expatriate labor underlines the limitation of local human resource at various levels. Given the growing demand for healthcare in the region, the healthcare sector needs to be promoted as cost-effective with global standards, but at the same time, creating local capacities. The countries of the region thus need to make the strategic choice of being part of a global value chain. The Indian healthcare sector could certainly be the driver. Healthcare regime-besides being technologically intensive-is culturally very sensitive, especially with reference to female medical care. As India and the Gulf countries enjoy cultural affinity, this could further facilitate India-Gulf collaboration in the healthcare sector.

Participating in the Gulf Digital Revolution

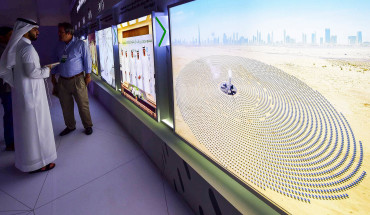

The Gulf region is reassessing its future profile on the strength of optimizing, rather than maximizing, its resources. The restructuring is designed to progressively shift from an extractive to an innovative digital economy in response to the aspirations of Gulf ‘millennials.’ In the contemporary phase of globalization, start-ups have emerged as key drivers of digital innovation. They represent a new organizing principle of promoting ideas and the application of technology into business at a small scale with limited finance. However, the principal requirement is to have a community of entrepreneurs to embark on calculated risk ventures. It also requires an ecosystem that encourages young talented individuals to take risks. In the wake of growing digitalization promoting jobless growth, start-ups are also seen as a future source of employment. In the United States, for example, though start-ups account for just 10 percent of all firms, they are responsible for creating 20 percent of jobs. Apart from employment generation, start-ups contribute in promoting creativity in the ecosystem. Being innovative and sometimes disruptive in nature, they enhance the competitive ethos in the market. That precisely has been the reason for their popularity among young entrepreneurs. Though prone to a high mortality rate, decline in their failure, meaning thereby their long life cycle is seen as ‘killer of entrepreneurship.”[8]

Viewed from the future perspective of the Gulf countries facing the challenge of youth unemployment and lack of employability, the strategy of diversification has to be premised on engaging youth productively into the economy. This imperative is echoed in various G.C.C. country vision statements and other policy pronouncements.[9] The 2016 Arab Human Development Report states categorically that the resilience of the region essentially depends upon the engagement of youth in nation-building processes, including their participation in the economy.[10] Though the G.C.C. governments are moving in that direction, the societal response is still very measured because the earlier social contract has created a rentier mindset. Although start-ups are small ventures, they nonetheless could, if cast appropriately, attract young Gulf citizens and help transform them into entrepreneurs. One major limitation Gulf countries face is the inadequate number of engineers.[11] It is in this context that the Gulf countries have to find ways to imbue youth with the sense of risk taking. Start-ups could be the leading platform if proactively engaged with start-up communities across the globe, including India.

Start-ups are playing vital role in promoting digitalization of the Indian ecosystem by developing digital-based solutions. “India serves as the fastest growing startup-base worldwide and stands third in technology driven product startups just after US and UK respectively. The digital revolution coupled with startup evolution has been instrumental in transforming India’s image as the repository of next big idea.” It is estimated that the number of Indian tech start-ups will reach 15,000 by 2020, contributing to digital solutions in a wide range of services in the banking, financial services, and insurance (BFSI) sector. What is significant is that the Indian start-ups are dynamically engaged in evolving a distinctive digital business ecosystem. It is this game-changing role played by start-ups that make them to be player in redefining the key driver of India’s economic relations with the Gulf countries.

The demographic imperatives and the constraints of natural resource endowment makes a strong case for the Gulf countries to promote the service sector as the anchor of diversification of their economy. The growing role of digitalization in the service sector has opened opportunities for young entrepreneurs to be part of the process. It is precisely for this reason that the governments in the Gulf countries are encouraging entrepreneurship development. Indian start-ups can take the lead by promoting collaborative ventures. There are signs that G.C.C. countries are seeking to forge such partnerships: “We want to bring young Saudis together with their peers across the world, to link them to global companies, and build up own mentoring capacity in the kingdom.”[12] Saudi Arabia reportedly has planned to allocate $270 million to promote start-ups. Soft Bank and the Kingdom have created $100 billion tech fund to promote start-ups.[13] Some initiatives seem to have been taken by Indian start-ups in the U.A.E.[14] Such initiatives, however, need not be framed as the importing of best digital practices but rather as the means by which to create the building blocks for transition to diversification.

Conclusion

In the larger frame of the global geo-economic shift, Asia’s resurgence is changing the nature of economic engagement among the Asian countries. The challenge lies in recasting the nature of the relationship between Gulf economies and their Asian counterparts in order to accelerate the pace of diversification processes. Though Asia will continue to import oil from G.C.C., the present market dynamics has made the latter compete for their share of the Asian market. However, as argued, the growing impulses of globalization driven by digitalization are disrupting the geopolitics of the hydrocarbon economy. The ‘new’ script of geopolitics is going to be written by the processes of political economy emanating from transition. The security and stability of the region lies with the success of transition. This is where India-G.C.C. relations could play the defining role.

[1] Rashmi Banga, “India’s Global Value Chains: Integrating LDCs,” Trade Express, August 2016, accessed December 28, 2016, https://www.researchgate.net/publication/308050341_India's_Global_Value….

[2] Governments in the G.C.C. region have acknowledged the economic and social benefits that going digital can bring, and have developed ambitious plans and strategies. Examples include Saudi Arabia’s Vision 2030 and National Transformation Plan 2020 (which covers the digital space), Smart Dubai, Qatar’s Connect 2020 ICT Policy, and Oman’s digital strategy (e-Oman). See “Preparing for the digital era: The state of digitalization in GCC businesses,” Strategy&, 2016, accessed December 28, 2016, http://www.ideationcenter.com/media/file/Preparing-for-the-digital-era….

[3] “Alpen Capital predicts steady growth for the GCC Healthcare industry,” Alpen Capital, February 16, 2016, accessed December 28, 2016, http://www.alpencapital.com/news/2016/2016-February-16.html.

[4] Ibid.

[5] “Indian Healthcare Industry Analysis,” India Brand Equity Foundation, updated January 2017, accessed January 6, 2017, http://www.ibef.org/industry/healthcare-presentation.

[6] It is estimated that 3,200,000 medical value travelers come to India for treatment. Of late this is growing at 30 percent annually. A good number of them come from the Gulf countries. Dubai-based airline, Emirates, has teamed up with Apollo Hospital in India to connect the Gulf medical needs with Indian hospital. The airline provides a package deal of service to the patients and their attendants. Times of India. See “India's medical tourism sector with international delivery capabilities attracts GCC patients: Apollo Hospitals,” Thomson Reuters Zawya.com, September 15, 2014, accessed January 6, 2017, https://www.zawya.com/story/Indias_medical_tourism_sector_with_international_delivery_capabilities_attracts_GCC_patients_Apollo_Hospitals-ZAWYA20140915125703/. See also Naushad Ahmad and Mohd. Zulkarnain Sikandar, “Medical Tourism in India from the Arab Gulf Region,” Business Dimension 1, 3 (2014): 183-200, accessed January 6, 2017, http://www.business-dimensions.org/dnload/Naushad-Ahmad-and-Mohd-Zulkar….

[7] Rajesh Chandramouli and Boby Kurian, “Abraaj Frontrunner to Buy Medall Healthcare,” The Times of India, January 4, 2017, accessed January 6, 2017, http://timesofindia.indiatimes.com/business/india-business/abraaj-front….

[8] “The Government’s First-Ever Survey of Entrepreneurs: What You Need to Know,” Indeed blog, September 1, 2016, accessed December 28, 2016, http://blog.indeed.com/2016/09/01/annual-survey-entrepreneurs-results/; and Tatjana de Karros, “US startup failure rates are declining - and it’s bad for the economy,” February 17, 2016, accessed January 6, 2017, https://www.linkedin.com/pulse/us-startup-failure-rates-declining-its-b….

[9] “Vision 2020” (Oman), “Vision 2021” (United Arab Emirates), “Vision 2030” (Bahrain), “National Vision 2030” (Qatar), and “Vision 2030” (Saudi Arabia).

[10] United Nations Development Program (U.N.D.P.), Arab Human Development Report 2016: Youth and the Prospects for Human Development in a Changing Reality, accessed December 28, 2016, http://www.arabstates.undp.org/content/dam/rbas/report/AHDR%20Reports/A….

[11] Vineet C. Nambiar, “How Gulf Countries Can Ignite Their Startup Revolution,” Techcrunch.com, August 8, 2015, accessed January 16, 2017, http://globalnewsconnect.com/how-gulf-countries-can-ignite-their-startu….

[12] “This Is How Saudi Arabia Plans To Be The Silicon Valley of the Middle East,” Inc.Arabia, November 17, 2016, accessed January 6, 2017, http://www.incarabia.com/wire/this-is-how-saudi-arabia-plans-to-be-the-….

[13] Deema Almashabi, Dinesh Nair and Matthew Martin, “Saudi Plans $270 Million Venture Fund for Startups,” Bloomberg News, June 2, 2014, accessed January 6, 2017, https://www.bloomberg.com/news/articles/2014-06-02/saudi-arabia-plans-2….

[14] Chiranjib Sengupta, “Indian startups ready to embrace opportunities in UAE,” Gulf News, February 8, 2016, accessed January 6, 2017, http://gulfnews.com/news/uae/government/uae-in-india/indian-startups-re….

The Middle East Institute (MEI) is an independent, non-partisan, non-for-profit, educational organization. It does not engage in advocacy and its scholars’ opinions are their own. MEI welcomes financial donations, but retains sole editorial control over its work and its publications reflect only the authors’ views. For a listing of MEI donors, please click here.